per capita tax burden by state

Change in per capita state and local taxes since 1960 for Washington and the average for all states. 50 rows We share the overall tax burden by state for an average household to help decide where to move.

Map Of Income Taxes And Social Securities By Country In Europe Map European Map Europe Map

1498 25th lowest General sales tax.

. The five states with the highest tax collections per capita are New York 9073 Connecticut 7638 New Jersey 6978 North Dakota 6665 and Hawaii 6640. Our ranking of Best And Worst States for Taxes captures the total tax burden per capitanot only for income property and sales tax but. Here are the five states with the biggest per capita tax burden according to their calculations.

All told Americans pay just over 5000 a year in state and local taxes equal to 98 of their estimated annual income. Effective state tax rate 50000 taxable income. State and Local Tax Revenue Per Capita.

Income tax collections per capita. Total taxes per capita. A per capita tax comparison is far from complete however because differences in the level of.

0 tied - the lowest Property tax collections per capita. The states with the lowest average combined state and local sales tax rates are Alaska 176 Hawaii 444 and Wyoming 522 while those with the highest average combined state and local. Download state_local_pcpdf 58051 KB Download state_local_pcxls 2415 KB.

State by state however this share varies from as. Finally New York Illinois and Connecticut are the states with the highest tax burden for the middle 60 by family income. Rankings of State and Local Per Capita General Revenue.

In the 1960s state and local tax burdens of about 115 per 1000 of personal income were typical for Washington and the state usually ranked. North Dakotans and Alaskans however are only paying a small share of that burden. Total taxes thousands Population Per capita State Alabama.

The average resident of a blue state pays 9438 in federal taxes while the average resident of a red state pays 6591. See more graphs about. Since so much of these states tax revenue comes from severance taxes the economic incidence of North Dakota and Alaska taxes is borne in significant part by.

51 rows State Total Tax Burden Property Tax Burden Individual Income Tax Burden. The effective tax burdens in these states are 125 122 and 116. The amount of federal taxes paid minus federal spending received per person by state can be found here.

1 Best Per Capita includes the population aged 18 and older. Federal Receipts. Effective state tax rate 50000 taxable income.

We have Alaska Delaware and Montana at the opposite end. Download dqs_table_79apdf 13371 KB Download dqs_table_79axls 445 KB August 26 2021. States are ranked from highest tax burden to lowest tax burden per person.

The most recent data available is from 2015. Rate at highest tax bracket. Federal Receipts.

With the exception of Taxpayer ROI all of the columns in the table above depict the relative rank of that state where a rank of 1 represents the lowest total taxes paid per capita and the best government services respectively. Rate at highest tax bracket. State and local tax burden.

Per Capita Tax Receipts by State 2015 The following per capita tax receipts describe how much money each state generates from taxes and compares it to the total population of that state. State and local tax burden. 1 District of Columbia DC.

Their effective tax rates by state for the middle 60 of earners are 43 58 and 67. Sales and gross receipt taxes. The five states with the lowest tax collections per capita are Alabama 3370 Tennessee 3405 Arizona 3472 South Carolina 3522 and Oklahoma 3544.

North Dakota ranks first with 7438 per capita and Alaska is second-highest with per capita collections of 7005. State and local tax. State and local tax.

The Kiplinger Tax Map Guide To State Income Taxes State Sales Taxes Gas Taxes Sin Taxes Gas Tax Healthcare Costs Better Healthcare

Average Tax Return In Usa By State And Federal Revenue From Income Taxes Per Capita In Each State Infographic Tax Refund Tax Return Income Tax

Average Tax Refund In Every U S State Vivid Maps Tax Refund Facts About America Map

Relative Value Of 100 Map Usa Map Cost Of Living

Tax Burden By State 2022 State And Local Taxes Tax Foundation

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

The States Where People Are Burdened With The Highest Taxes Zippia

State Diesel Tax Rates 2013 Infographic Map Safest Places To Travel Safe Cities

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

Ranking Unemployment Insurance Taxes On The 2019 State Business Tax Climate Index Legal Marketing Local Marketing Business Tax

U S Cigarette Consumption Pack Sales Per Capita Vivid Maps Map Old Maps Cartography

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

West Virginia Has Some Of The Lowest Property Taxes In The Nation As Indicated In White On This Map Property Tax Map Us Map

Mapsontheweb Infographic Map Map Sales Tax

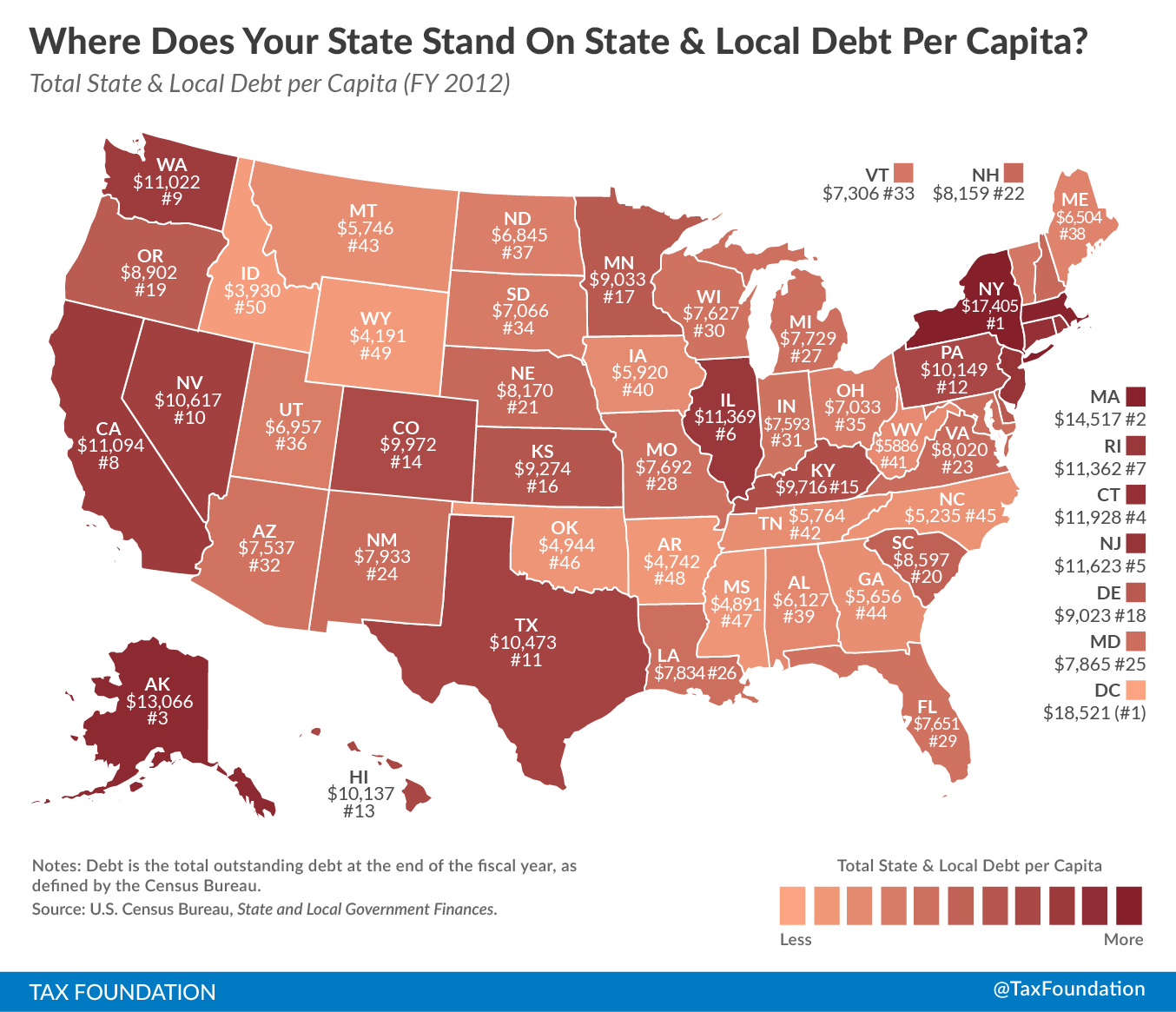

Where Does Your State Stand On State Local Debt Per Capita Tax Foundation

Americans Are Migrating To Low Tax States Native American Map American History Timeline United States Map

State Local Property Tax Collections Per Capita Tax Foundation